Deep Learning for Better Option Pricing

An in-depth walkthrough of a use case for deep learning (GANs) in the finance industry.

learn more

For most modern businesses, talking about data science, machine learning, and – increasingly – AI is exciting. It’s the future, and it means cutting-edge development and change. For financial services, these terms tend to evoke less enthusiasm and more fear (especially when the term “black box” comes up). And rightfully so – to be sure, the industry’s relative hesitation in embracing these technologies is thanks in part to a generally stricter and higher-stakes regulatory environment.

There’s no denying that it requires financial service companies to be prudent. Yet despite these challenges, there are some institutions rising above the rest, working on the cutting-edge of the data science world in creative applications that improve business results and make the customer experience better.

Unfortunately, machine learning is not really an accepted or mainstream practice in the financial service industry for compliance reasons. That’s partly because whenever someone talks about ML, everyone’s mind goes to underwriting – but not us. We found several other opportunities to be much more attractive.

– Evgeny Pogorelov

Director of Decision Science at Marlette Funding

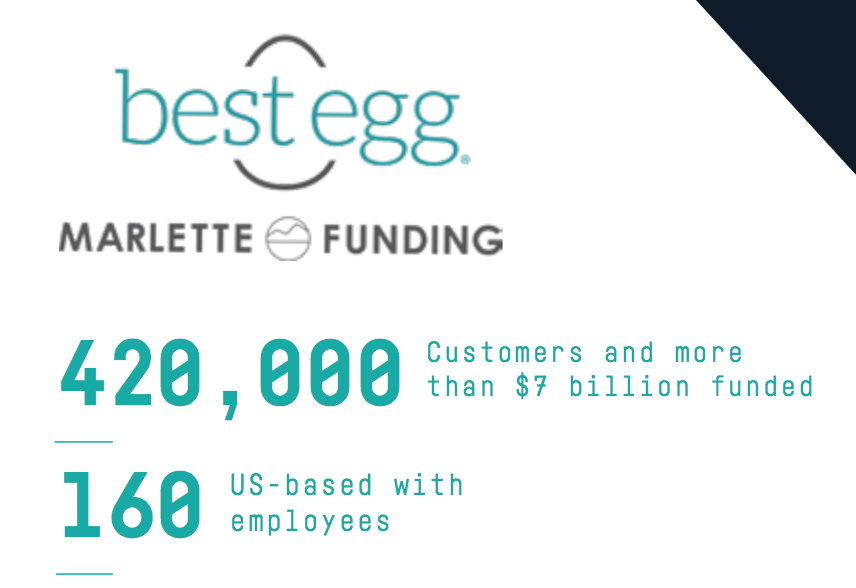

Marlette Funding, Best Egg Loans is using machine learning (ML) to transform business processes across the organization in revolutionary ways. To make sure they produce a best-in-class fraud detection model for their first foray into ML (and best-in-class data projects in general when working with other parts of the business), the six person team at Marlette Funding:

Most of the business units at Marlette Funding have their own analysts who look at data and for opportunities for more advanced analytics. From there, they can approach the central data team to collaborate on projects together. This allows the technical skills of the data team to be enhanced by the business knowledge of the analysts and other experts in business units for more optimal project results.

The data science team doesn’t have a business function on its own – it serves the entire business. So the data team worked with the fraud operations team, for example, who can provide the relevant data and knows the overall fraud strategy.

– Evgeny Pogorelov

Director of Decision Science at Marlette Funding

“The way we see it, we’ve already done all the traditional modeling and looked at the traditional data. If we want to be the best in class (the best in marketing, the best in fraud detection, the best in customer service, the best in pricing, etc.), we need to go beyond the traditional tools.”

– Evgeny Pogorelov

Director of Decision Science at Marlette Funding

In this EGG talk, Martin Leijen shares how Rabobank determines and protects their privacy and ethical standards, as well as how financial institutions can we effectively maintain a firm commitment to moral and ethical standards while at the same time encouraging a strong drive to optimize business opportunities and profitability.

Read moreAn in-depth walkthrough of a use case for deep learning (GANs) in the finance industry.

learn moreMost banks fundamentally have a lot of the pieces in place already for AI; this white paper walks through challenges, use cases, and initiatives to start now.

get the white paperA quick walk-through of the best path forward for banks getting started in AI.

learn moreGet a demo of an end-to-end use case for putting a machine learning-based fraud detection system in production.

watch now